Ex-Invesco fund manager acquires stake in diversified South African industrial group

Jason Holzer, a former senior portfolio manager at Invesco, now owns 5% of JSE-listed Argent Industrial Ltd.

A former Invesco portfolio manager has acquired a beneficial interest in Argent Industrial Limited, a JSE-listed South African steel manufacturer and trader. According to a SENS update from the Johannesburg Stock Exchange, Jason Holzer now owns 5.09% of Argent Industrial’s total issued ordinary share capital.

Holzer, who retired from Invesco in 2021 after 25 years at the firm, is now the fifth largest shareholder in Argent Industrial. While at Invesco, Holzer managed a number of European and global (ex-US) equity portfolios. Other top shareholders in Argent Industrial include Morgan Stanley & Company, Clearstream Banking S.A. Luxembourg, Giflo Trading Proprietary Limited, and the Government Employees Pension Fund.

Argent Industrial, the holding company, sells and trades manufactured steel and steel-related products such as metal gates, railings, and shutters. It owns over 20 vertically-integrated subsidiaries in South Africa, the UK, and the US while it sends exports to over 35 countries globally. The Argent group of companies also includes a number of jet refuelling and fuel storage businesses.

Over the years, Argent Industrial has expanded via judicious acquisitions. In 2021, it acquired South Africa-based American Shutters, a supplier of “a stylish door and window shutter security system” for ZAR57 million. A year earlier, it acquired UK-based Partington Engineering, a supplier of bespoke trolleys for both the traditional and e-commerce retail sectors, for GBP3.1 million.

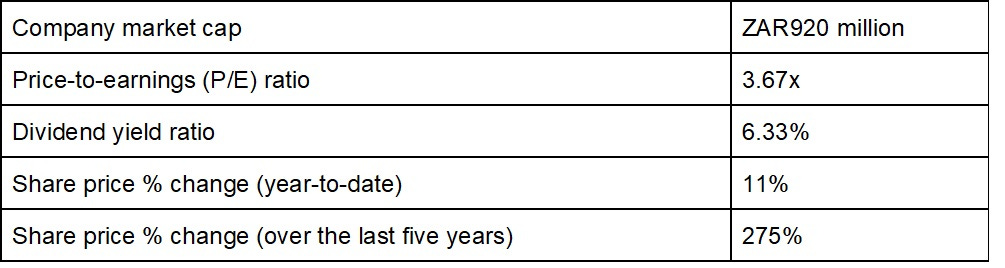

Last year, Argent Industrial reported a 23% increase in profits from ZAR192 million in 2022 to ZAR236 million in 2023. Over the last five years, basic earnings per share (EPS) have also risen significantly from ZAR1.012 to ZAR4.131, an increase of over 300%. In addition, gearing levels have dropped from 23.1% in 2020 to 9.4% last year.

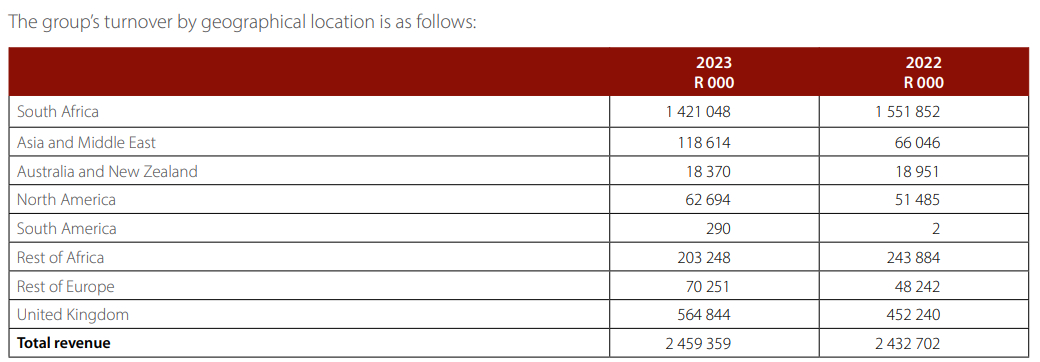

In March 2023, group CEO Treve Hendry said he was optimistic about the group’s prospects, particularly its strategy of investing in stable, developed international markets like the UK and the US. “The group’s overseas operations have had an incredibly good year and are expected to run at similar levels given their current order book,” he said.

He continued, “The South African operational units have done well […] consolidating their local positions and increasing their export base. [However], the current elected party has made an absolute mess of the SA markets and [that] is the inspiration [for placing] the company’s operations and production elsewhere in the world.”

Key company financials:

According to Simply Wall Street, Argent Industrial’s main rivals are Trellidor Holdings, Marshall Monteagle, enX Group, and Bell Equipment.

© Capital Markets Africa, 2024

Founded by journalist Chipo Muwowo, Capital Markets Africa aims to raise the profile of African listed companies. Whether you're a retail or institutional investor, based in Africa or outside, we want you to be better educated about the investment opportunity set and the broader African equities market ecosystem. Subscribe today!